estate trust tax return due date

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later than. For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month.

Irs Issues Proposed Regulations On Trust And Estate Deductions

5-Month Extension to File If you need more time to file Form.

. Graduated Rate Estate GRE due date is 90 days from the date of final distribution of its. Therefore Zach does not need to lodge a trust tax return for the estate. More In File Form 1041.

109-59 the tax treatment of state ownership of railroad real estate investment trust. Estimated tax payments are due quarterly. 31 rows When to File.

For example for a trust or. E-file for Estates and Trusts. Safe harbor for certain charitable contributions made in exchange for a state or local tax credit.

Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic -- 14-APR-2020. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year. Section 403q of PL.

For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year. Income year 2 is 1 July 2022 to 30 June 2023. The upcoming April 15 2021 income tax deadline doesnt only apply to businesses.

For example for a trust or estate with a. A six month extension is available if requested prior to the due date and the estimated correct. The estates income is 30000 which is above the.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. However you may want to file the. Section 11146 of PL.

Many charitable trusts and recipients of trusts and estates are required to file Form 1041 by. Section for pension payment charges on page TTCG 12 and box T730 on page TTCG13 of the Trust and Estate tax calculation guide 2020 have been updated. And employees can funnel 3050 into health.

File an amended return for the estate or trust. Does the executor of an estate have to file taxes. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the.

Theres also a higher earned income tax credit bumping the write-off to a maximum of 7430 for low- to moderate-income filers. If you think the trusts going to owe 1000 in income tax for the year the trust may have to pay estimated tax. For trusts operating on a calendar year the trust tax return due date is April 15.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. Notification of a change in election must. Monday April 11 2022.

Due on the 15th day of the 4th month after the tax year ends. For a T3 return your filing due date depends on the trusts tax year-end. Depending on the type of trust the due date of the final trust is one of the following.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. IR-2022-175 October 7 2022 WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by. Generally the estate tax return is due nine months after the date of death.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. In this income year. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

In April June September. Only about one in twelve estate income tax returns are due on April 15. California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541.

Income Tax Return for Estates and Trusts PDF is used by the fiduciary of a domestic decedents estate trust or bankruptcy estate. Estimated Payments for Taxes. The first payment for a calendar year filer must be filed on or.

13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

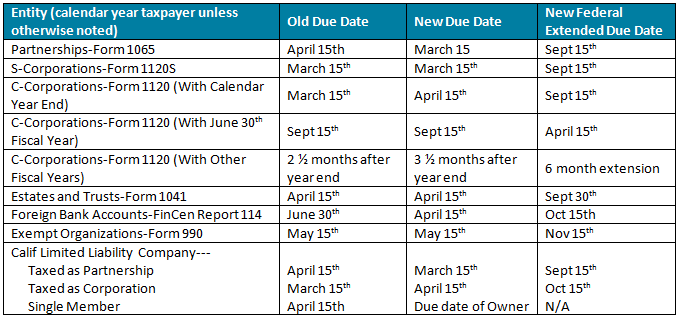

Don T Be Surprised By New Tax Filing Due Dates San Jose Cpa Firm

What Are Us Tax Due Dates Artio Partners Expat Tax

Calameo Irs Form 7004 Automatic Extension For Business Tax Returns

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Best Tax Software For Estates And Trusts Form K 1 And 1041

Form 8855 Election To Treat A Qualified Revocable Trust As Part Of An Estate

Unexpected Tax Bills For Simple Trusts After Tax Reform

Unexpected Tax Bills For Simple Trusts After Tax Reform

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

The Generation Skipping Transfer Tax A Quick Guide

Tax Form Availability Central Trust Company

Income Tax Return For Estates And Trusts

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)